International Tax Services

November 22, 2022Обзор InstaForex: официальный сайт, регистрация на instaforex com, отзывы и условия

December 22, 2022

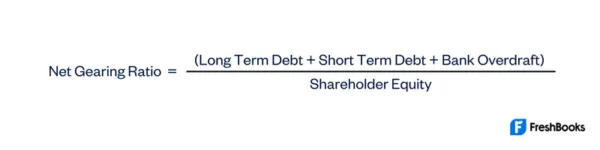

While firms with higher gearing ratios generally carry more risk, regulated entities such as utility companies commonly operate with higher debt levels. There are many types of gearing ratios, but a common one to use is the debt-to-equity ratio. To calculate it, you add up the long-term and short-term debt and divide it by the shareholder equity. If you don’t have any shareholders, then you (the owner) are the only shareholder, and the equity in this equation is yours.

Interpretation: What Is an Ideal Leverage & Gearing Ratio?

Companies in monopolistic situations often operate with higher security checks because their strategic marketing position puts them at a lower risk of default. Industries that use expensive fixed assets typically have higher gearing ratios because these fixed assets are often financed with debt. The capital gearing ratio is the ratio of all capital with a fixed return (i.E., Preference share capital plus long-term liabilities) to all capital with a variable return (i.E., Ordinary share capital).

Understanding Gearing Ratio: Definition, Formula & Examples

These ratios tell us that the company finances itself with 40% long-term, 25% short-term, and 50% total debt. Here, we explore how to compute the gearing ratio using debt and shareholder’s equity. The optimal debt-to-equity structure is a factor of many things, including the firm’s weighted average cost of capital, the cost of equity, and the cost of debt that the company has.

Gearing vs. Risk

Having a high gearing ratio means that a company is using more debt to fund its operations, which may increase the financial risk. But high ratios may work well for certain companies, especially if they are capital-intensive as it shows they are investing in their growth. A low gearing ratio suggests that a company is primarily financed by equity. This could signify financial stability, as the company relies less on external financing. However, it could also indicate a lack of growth opportunities, as companies often use equity financing when not investing heavily in new projects.

- Conversely, a low gearing ratio indicates that a company is primarily financed by equity, which may suggest a more conservative approach to financing.

- For instance, start-ups and rapidly growing companies often have high gearing ratios because they need to borrow heavily to finance their expansion.

- Gearing ratios are also a convenient way for the company itself to manage its debt levels, predict future cash flow and monitor its leverage.

- The Debt Ratio, on the other hand, requires dividing total liabilities by total assets.

- Each gearing ratio formula is calculated differently, but the majority of the formulas include the firm’s total debts measured against variables such as equities and assets.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

How can companies reduce their gearing?

Or you can use two equal-sized gears if you want them to have opposite directions of rotation. Since this is less than 4 and does not meet the bank’s expected ratio, it will now have to provide a guarantor or mortgage of the property as stipulated. While there are different definitions in different context, the important thing is to look at the context and infer what definition is likely In use. If an exact definition is required, for example in a loan document, then there will be a Capitalised Ratio Name and an Agreed Definition, always spelt with Capitals in the document.

A higher ratio indicates higher financial risk yet potentially higher returns. Conversely, a lower net gearing ratio may signify financial stability but potentially lower returns. Finding the optimal gearing ratio helps investors understand a company’s financial health and risk level. Financial gearing ratios are a group of popular financial ratios that compare a company’s debt to other financial metrics such as business equity or company assets. Gearing ratios represent a measure of financial leverage that determines to what degree a company’s actions are funded by shareholder equity in comparison with creditors’ funds. The Debt-to-Equity Ratio is a fundamental measure that compares a company’s total liabilities to its shareholders’ equity.

This ratio provides a measure to which degree a business’s assets are financed by debt. Currently, XYZ Corp. has $2,000,000 of equity; thus, the debt-to-equity (D/E) ratio is 5×—[$10,000,000 (total liabilities) divided by $2,000,000 (shareholders’ equity) equals 5×]. With this information, senior lenders might choose to remove short-term debt obligations when calculating the gearing ratio, as senior lenders receive priority in the event of a business’s bankruptcy. Effectively managing gearing ratios is essential for maintaining a balanced financial structure and ensuring long-term sustainability.

The Debt-to-Equity Ratio describes the total debt that the company draws against the total equity that the owners of the company have raised. To create large gear ratios, gears are often connected together in gear trains, as shown on the left. When looking at a company’s gearing ratio, be sure to compare it to that of similar businesses. We will first calculate the company’s total debt and equity and then use the above equation. For corporates, i.e. non-financial companies, a ratio of less than 100% is considered normal. Keep in mind that debt can help a company expand its operations, add new products and services, and ultimately boost profits if invested properly.

As such, a firm’s gearing ratio can fluctuate significantly based on its industry and stage of development. For instance, start-ups and rapidly growing companies often have high gearing ratios because they need to borrow heavily to finance their expansion. On the other hand, established companies with steady cash flows tend to have lower gearing ratios. The results of gearing ratio analysis can add value to a company’s financial planning when compared over time. But as a one-time calculation, gearing ratios may not provide any real meaning. If your company had $100,000 in debt, and your balance sheet showed $75,000 of shareholders’ or owners’ equity, then your gearing ratio would be about 133%, which is generally considered high.