What Is A Chief Know-how Officer? Cto Position Defined

June 2, 2023Public Offering Price POP: Meaning, Process, Researching Prices

July 24, 2023

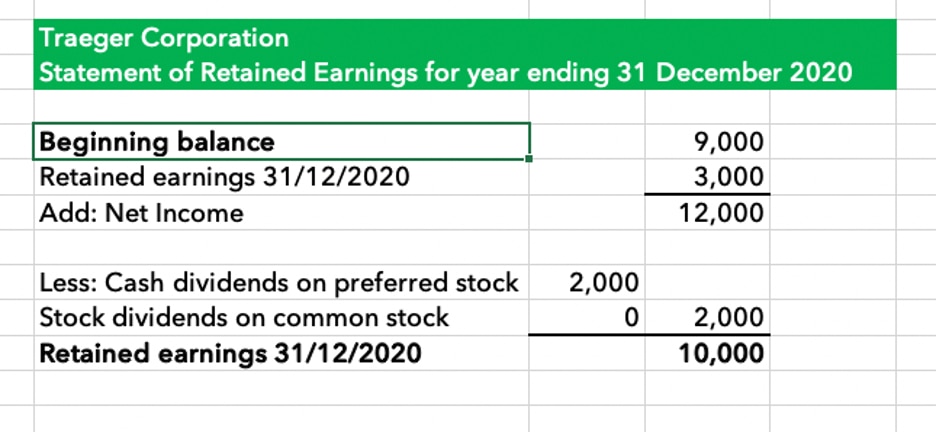

It is the opposite of the payout ratio, which measures the percentage of profit paid out to shareholders as dividends. The statement of retained earnings is a financial statement that reports the business’s net income or profit after dividends are paid out to shareholders. This statement is primarily for the use of outside parties such as investors in the firm or the firm’s creditors.

Why Is the Retention Ratio Important?

For example, if a company is considering purchasing new equipment, the model can simulate different scenarios, such as varying costs, financing options, and expected returns. This analysis aids in determining whether the investment is financially viable and aligns with the company’s strategic goals. You can also move the money to cash flow to pay for some form of extra growth. Retained earnings are calculated by subtracting a company’s total dividends paid to shareholders from its net income. This gives you the amount of profits that have been reinvested back into the business. A statement of retained earnings shows the changes in a business’ equity accounts over time.

How to Prepare a Statement of Retained Earnings: A Step-by-Step Guide with Example

For those who’ve been in the financial reporting game, this familiar number is your last performance’s curtain call, carried forward as the opening act for the new period. If this is your debut statement, then you’re starting from scratch—your opening balance is zero. Remember, your beginning balance isn’t just an arbitrary number; it embodies the company’s cumulative earnings minus cumulative dividends since day one. Think of it as a financial saga that sets the stage for the current period’s financial storytelling. To kick things off with preparing a statement of retained earnings, you start with a sprint down memory lane – the beginning balance.

Our Services

This number isn’t just another entry on the books; it’s the measure of your company’s accumulated wealth over time that hasn’t been dished out to shareholders. Dividends are the slices of the profit pie that shareholders eagerly await, representing a reward for their investment in your company. But bear in mind, this isn’t a compulsory tradition; some companies choose to reinvest profits back into the business instead.

However, to calculate retained earnings from the balance sheet, you take out dividends, along with net income or loss. Whenever a company generates surplus income, a portion of the long-term shareholders may expect bank reconciliation definition and example of bank reconciliation some regular income in the form of dividends as a reward for putting their money in the company. Traders who look for short-term gains may also prefer getting dividend payments that offer instant gains.

- If the company is experiencing a net loss on its Income Statement, then the net loss is subtracted from the existing retained earnings.

- This statement of retained earnings can appear as a separate statement or be included on either a balance sheet or an income statement.

- At some point in your business accounting processes, you may need to prepare a statement of retained earnings, which helps people understand what a business has done with its profits.

- Some companies don’t have dividend payouts—in that case, there’s nothing to subtract.

Financial Statement Modeling

It’s about signaling stability and foresight in your business model. Calculating the ending retained earnings solidifies your company’s financial narrative, reflecting both past decisions and setting the stage for future investments or debt management. It’s a number that tells a story, so make sure it’s penned with precision and clarity. When you subtract dividends from your net income, you’re essentially closing the loop of your retained earnings calculation. It’s a subtraction that underscores a company’s generosity and investor-centric ethos or highlights a strategic choice to harness profits for growth. The plot behind this step revolves around the outcome of your business’s operations.

Once you have all of that information, you can prepare the statement of retained earnings by following the example above. When you’re through, the ending retained earnings should equal the retained earnings shown on your balance sheet. Learn how to build, read, and use financial statements for your business so you can make more informed decisions.

Following our example, Widget Inc. begins their fiscal year with retained earnings of $15,000. The company has worked hard throughout the year, leading to a well-earned net income of $10,000. Shareholders are not forgotten, as dividends amounting to $3,000 are paid out. While the calculation itself is straightforward, the thought process behind how much to retain versus distribute in dividends reflects a company’s long-term strategic planning and fiscal discipline. It’s essential to fine-tune these numbers as they send a strong message about the company’s financial stewardship and future prospects. Walking through this example, it’s evident that Zippy Tech is maintaining a healthy cycle of profit reinvestment while also rewarding its shareholders.

The statement of retained earnings is also important for business management as it allows the firm to determine its retention ratio. The retention ratio is the percentage of net income that is retained. For example, if 60% of net income is paid out as dividends, that means 40% of net income is retained. A statement of retained earnings is a financial statement that shows the changes in a company’s retained earnings balance over a specific accounting period.

The income statement and cash flow statement are linked through net income, which serves as the starting point for cash flow from operating activities. Revenue growth is one of the most fundamental assumptions in financial projections, as it influences other forecast components like expenses, profit margins, and cash flow. Revenue forecasting estimates future sales based on historical data, market trends, and strategic initiatives. It’s the starting point for many financial forecasts, as revenue affects other components such as expenses and working capital.

Revenue is the total income earned from sales before expenses, while retained earnings are the profits kept by the company after paying out dividends over time. Pour too much into dividends, and the retained earnings dwindle, possibly signaling a lack of internal investment capital. But strike the right balance, and you’re likely to attract investments while still rewarding shareholders.